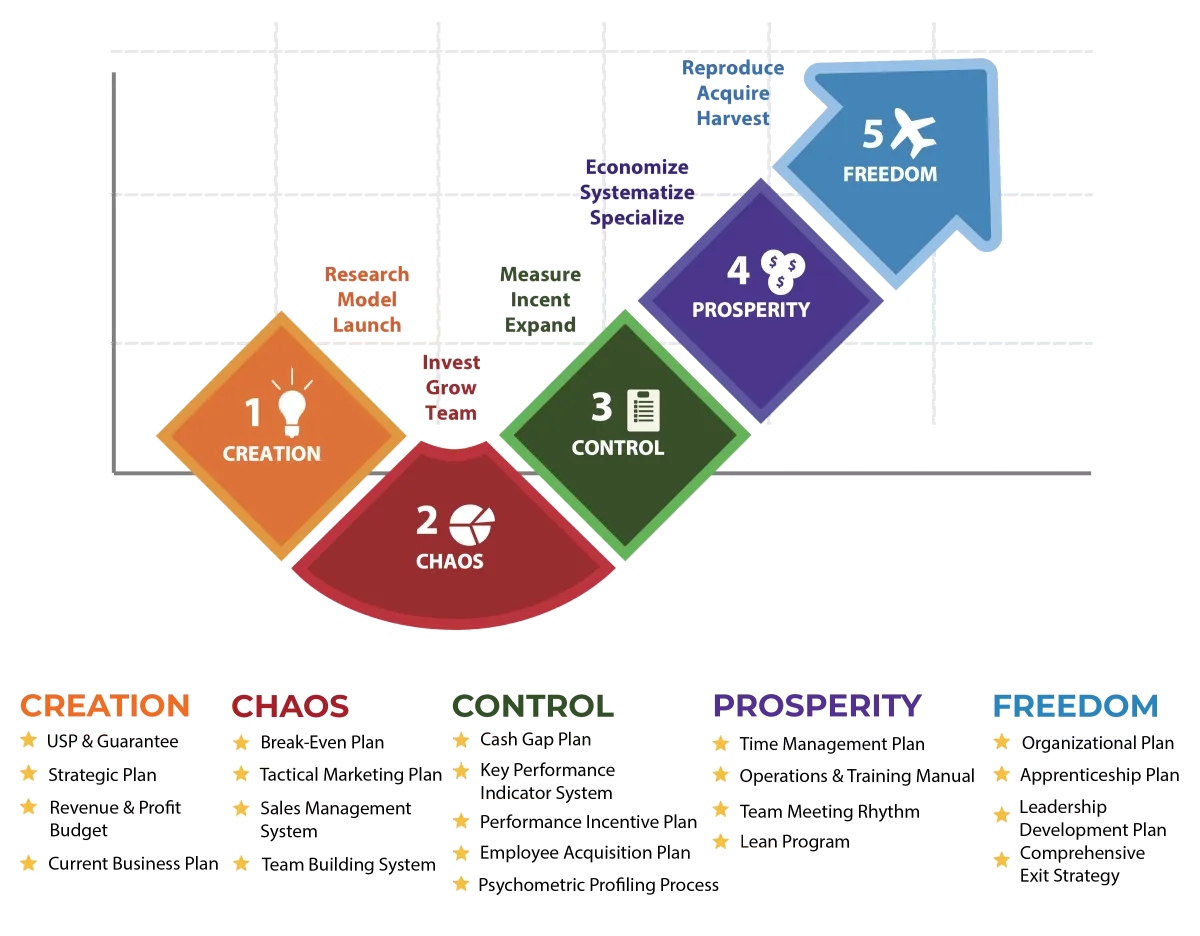

Where Is Your Business On The

5 Steps To Freedom?

And What Should You Do Right Now to Move Your Business Toward the Freedom Step?

Get Your Scorecard

Hi , please take time and fill out the survey form to get your scorecard !

Let's embark on a discovery! Measure your business against these criteria for each of the 21 Silver Bullets:

(5) Stupendous/Always, (3) Adequate/Occasionally,

(1) Inadequate/Seldom.

Privacy Policy | Terms and Conditions